Utah Businesses: Take Advantage of a 30% Tax Credit for EV Charging Installations

Are you aware that the Alternative Fuel Vehicle Refueling Property Credit (Section 30C), eligible properties can receive a 30% federal tax credit—up to $100,000—toward the cost of EV charging infrastructure?

Whether you're a property developer, commercial landlord, or part of a multi-unit residential community, this incentive is designed to offset costs and future-proof your facilities as electric vehicle adoption continues to rise.

Support for Property Managers & Developers

Utah offers several support systems and organizations that simplify the path to energy-efficient development:

- Energy Rated Homes of Utah (ERHU): ERHU partners with builders and developers to promote affordable, energy-efficient housing. They offer expert guidance on utility rebates and incentives for building to EPA Energy Star standards—great for new construction or major retrofits.

- Utah Clean Cities and Communities: This organization actively maintains a list of funding opportunities, grants, and clean transportation initiatives. It’s a key resource for staying updated on local, state, and federal programs that support clean energy deployment.

Local Incentives & Resources

Utah municipalities are also offering their own unique programs to support energy-conscious development:

Utah municipalities are also offering their own unique programs to support energy-conscious development:

- Salt Lake City: Offers an array of incentives for green building and conservation, including a Revolving Loan Fund and expedited green building plan reviews for qualifying projects. Visit SLC.gov for details.

- Sandy City: Provides customer-focused energy incentive programs that include product discounts, cash-back options, and monthly utility savings for homeowners and property managers improving energy efficiency.

- UAMPS (Utah Associated Municipal Power Systems): In coordination with local cities, UAMPS supports distributed energy programs that enhance energy efficiency across Utah communities.

Maximize Benefits with the 30C Federal Tax Credit

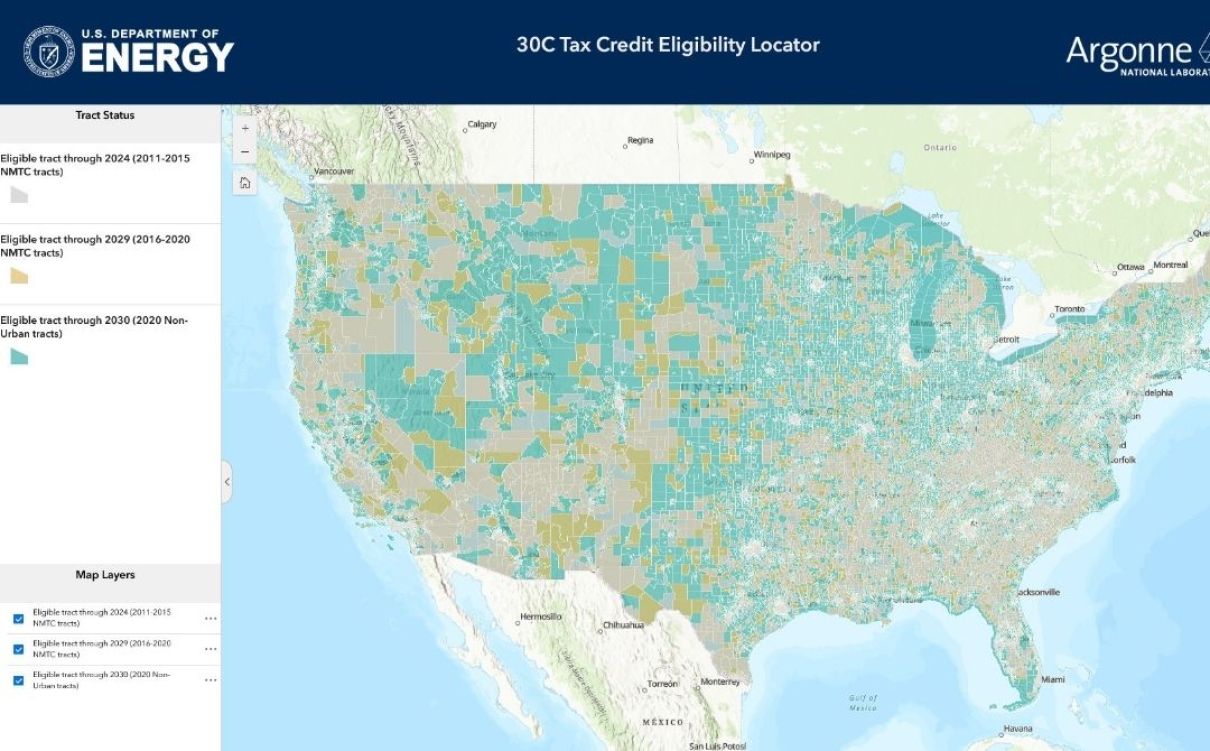

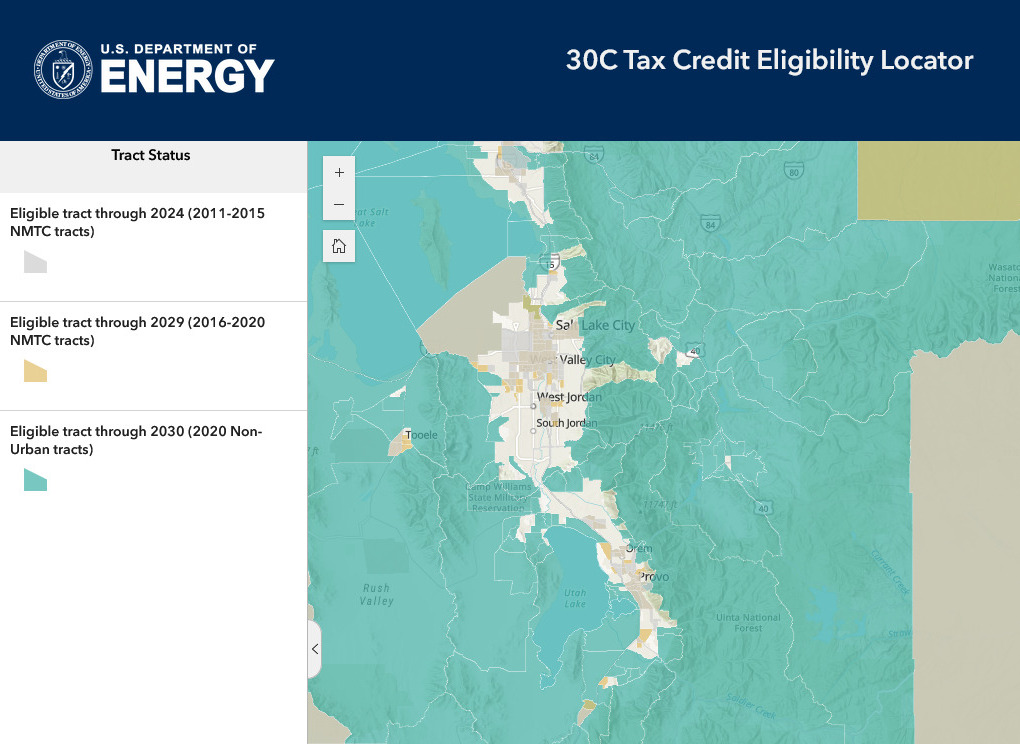

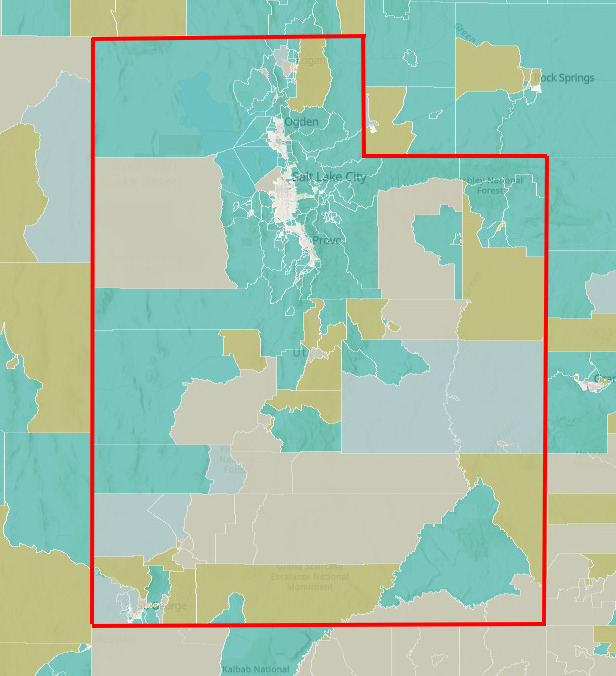

The 30C tax credit is a major financial incentive—but it's not available everywhere. The IRS limits eligibility to properties located within specific census tracts (low-income and non-urban areas).

The 30C tax credit is a major financial incentive—but it's not available everywhere. The IRS limits eligibility to properties located within specific census tracts (low-income and non-urban areas).

This makes it essential to verify your property's location before applying.

Federal funds are available in tax credits!

Next Steps

- Assess Eligibility: Identify which state and local incentive programs apply to your specific property type and development plans.

- Check for 30C Eligibility: Use this interactive map to determine if your property is in a qualifying census tract. If it is, you're likely eligible for the 30% rebate - no waiting! Many of these projects can be deployed within a month by Halo Hybrid!

- Consult Professionals: Partner with certified contractors—like Halo Hybrid—who are experienced with Utah’s energy programs and rebate processes.

- Apply for Incentives: Gather your documentation, confirm your eligibility, and begin submitting applications for rebates and tax credits.

Why Work with Halo Hybrid?

Halo Hybrid helps Utah developers, property owners, and municipalities take full advantage of EV charging and solar infrastructure incentives—whether you're eligible for the 30C rebate or not. Our turnkey solutions simplify compliance, maximize savings, and boost long-term value.

Currently we’re experiencing price volatility due to tariffs, book now before prices go up!

Ready to Find Out If You Qualify?

Check your address today using this 30C eligibility map. If you’re in an approved area, you could save tens of thousands of dollars—and HaloHybrid.com is ready to help.

Build smarter. Save more. Go electric.

Learn how Halo Hybrid can help with your next project.